Call for enquiry: (233) 302979979

Digital Onboarding

With Customer

Identity

Verification

THE HID IDENTITY VERIFICATION SERVICE IS AN OFF-THE-SHELF,END-TO-END SOLUTION FOR DIGITAL ONBOARDING AND KYC COMPLIANCE

The HID Identity Verification Service runs a suite of advanced technical checks against every

customer submission to ensure that identities are thoroughly authenticated and verified. Your

business is protected from fraudulent identities that have been tampered with or forged, as you

offer customers a more user-friendly onboarding experience.

Across the globe anti-money laundering directives are becoming more stringent, requiring regulated firms to verify the

identities of their clients prior to engaging in any commercial activities. This verification process is referred to as Know

Your Customer (KYC) and Anti Money Laundering (AML). Whilst KYC/AML is necessary to prevent against fraudulent

and other illegal activities, it is often a source of inconvenience and frustration for both the business and the customer.

The challenge is that most onboarding processes deployed in the past are manual and cumbersome for firms and

their customers causing minimal compliance practices, significant cost increases when acquiring new customers and

customer drop off—all of which result in lost business. In addition, since the large shift toward a more connected

world, customers are starting to demand a fully digital identification process that enhances the entire user experience.

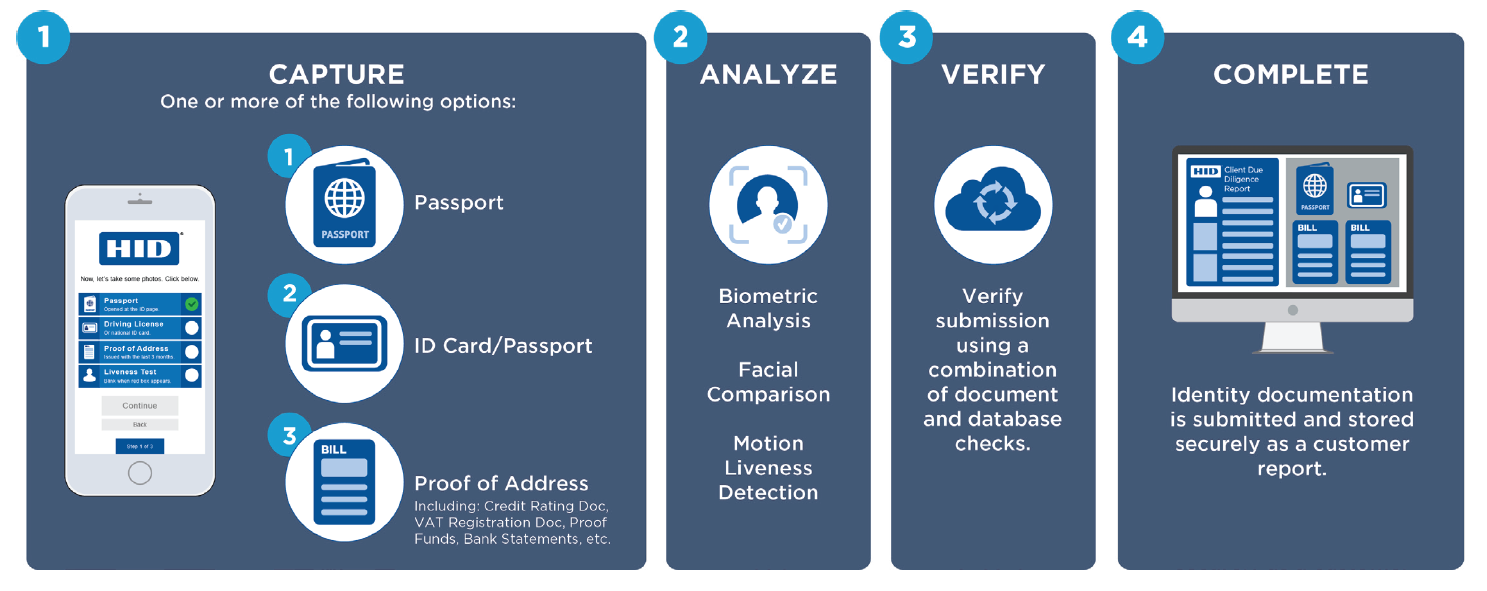

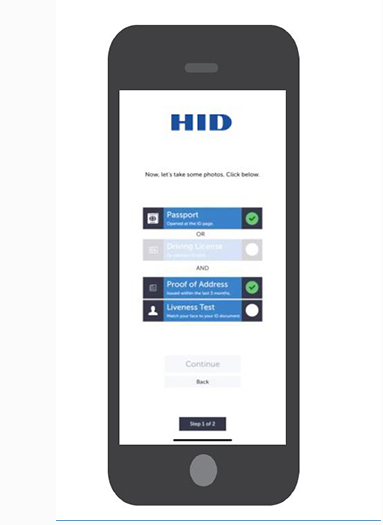

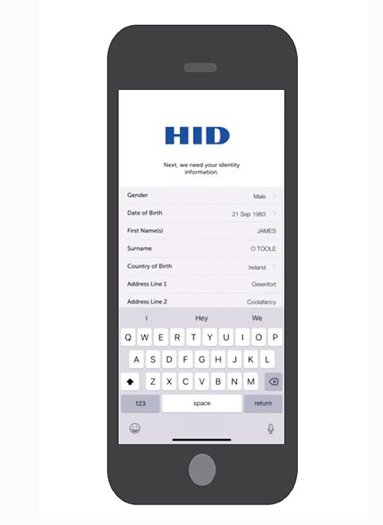

With the HID Identity Verification Service, you will become KYC compliant just by asking your customers to go

through a few simple steps on a highly secure, user-friendly mobile application—either remote or in person.

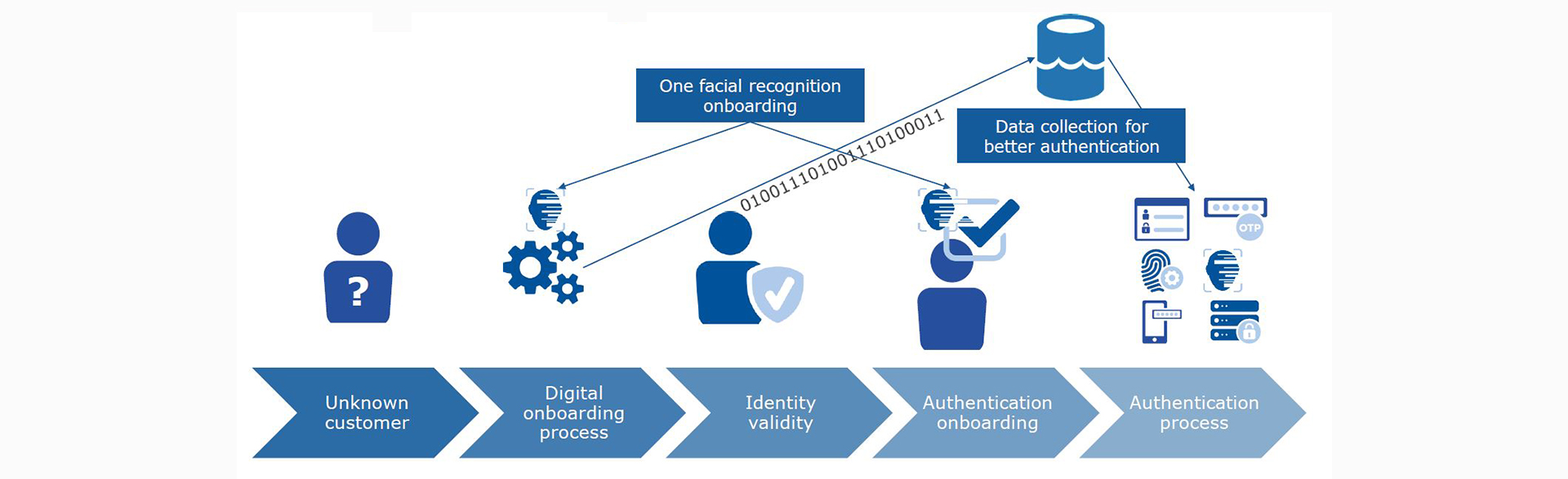

HID Identity Verification Service can be integrated with HID Authentication Platform and HID Risk Management

Solution to deliver to the customer a secure and consistent, end-to-end digital identity life cycle user experience.

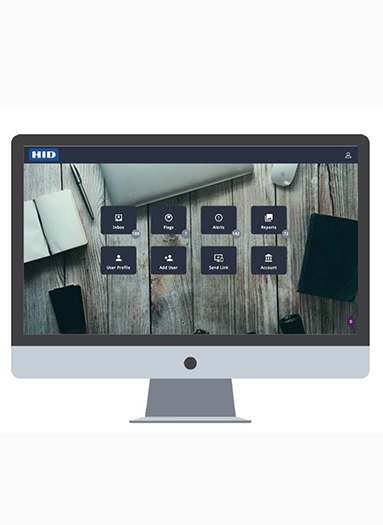

Businesses can white label, configure and integrate this solution with minimal or no development effort. HID Identity

Verification Service offers three platforms from which to choose:

- Customer App—Customer submits identity information to the business remotely.

- Business App—Business captures customer information in-person.

- Web Portal—Robust, multi-layered online verification of submission.

KEY FEATURES

- Deployed either through SDK integration or standalone application.

- Supports 6000+ documents across 200+ countries.

- Politically Exposed Person (PEP) checks and sanction screening for 200+ countries.

- Database checks verify proof of address.

- Comprehensive Customer Due Diligence report generated.

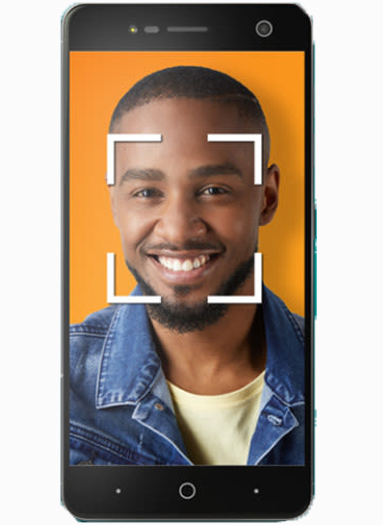

- Customer’s personal information auto-populated in app.

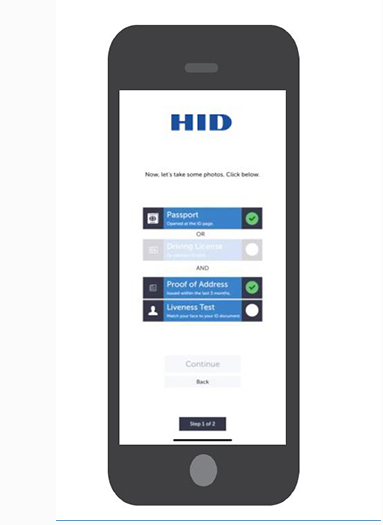

- Liveness detection and gesture recognition prevents identity fraud. Liveness test includes gesture analysis and eye blink tracking to detect a live person.

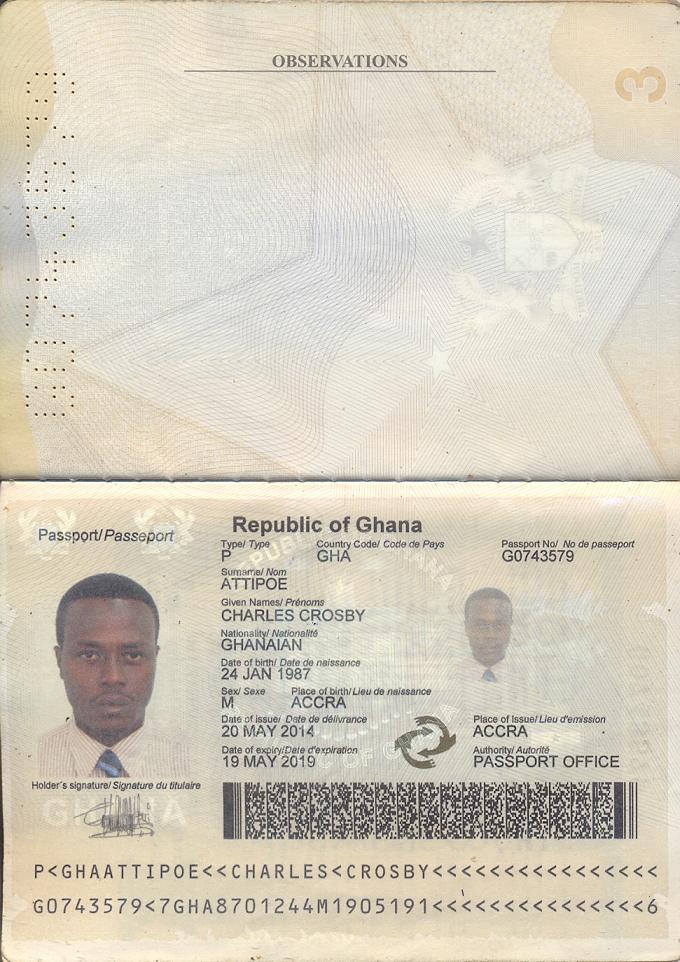

- Facial Comparison, 50-point biometric facial match.

- Document Verification offers a full suite of validations, including tampering and check forgery.

- Additional checks via video analysis of identity documents

- GDPR-compliant cloud solution.

- Possibility for white labeling on back-office application and mobile application.

VERIFICATION TESTS

- Liveness Check: motion detection and gesture recognition prevents identity fraud.

- Facial Comparison: 50 point biometric facial match.

- Document Verification: full suite of tampering and forgery checks.

- Data Verification: database checks verify proof of identity and proof of address.

- Video Analysis: additional checks via video. analysis of identity documents.

A complete Digital Onboarding solution

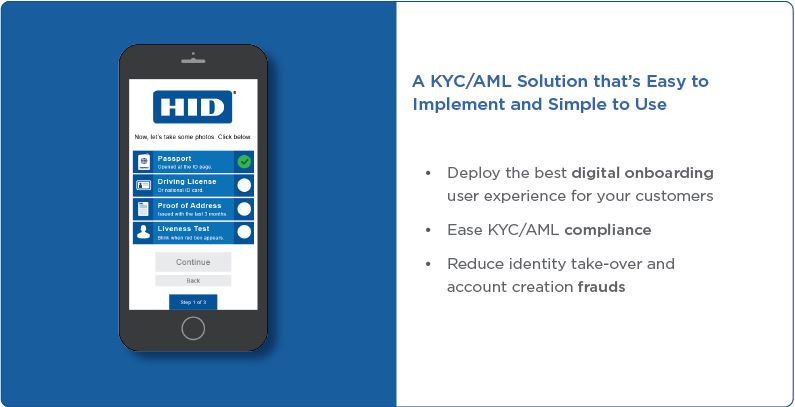

A KYC Solution that's easy to implement and simple to use

- Complete Omnichannel Solution integrated in: 1-2 day(s)

- Real-Time Identity Verification with first time approval: 93%

- No Hidden Costs – monthly subscription based on volumes

Improved security: AI Threat Detection with HID RMS

Identity is the new perimeter

Business Sends Link To Customer

The business logs into the web portal and sends the Customer a link to the HID app

Note: this process can be automated

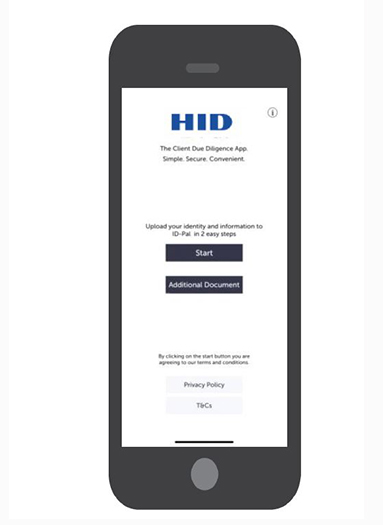

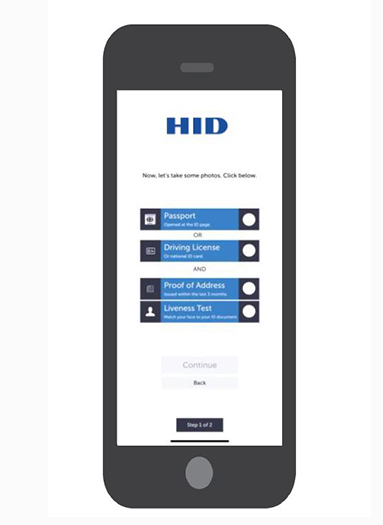

Customer Downloads App

The Customer downloads the HID app

(or Client app using Simplified SDK) and follows the easy on screen instructions to capture standard ID

information

Verify Identity Document

Customer takes a photo of their

- Driving license

- Passport

- National Identity Card

- Health Insurance Card

Capture Proof of Address

Customer takes a photo of a recent utility bill

Take Liveness Test

Customer is prompted to blink into the camera once rectangle marks appears

Customer Submits Info

Customer reviews the auto populated personal information fields and securely submits to the Business

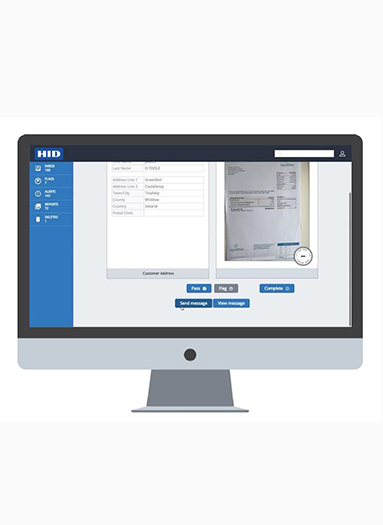

Business Reviews Submission

Business reviews and verifies the submission via the HID web portal Biometric checks ensure the person

who submitted the documentation is it’s rightful owner

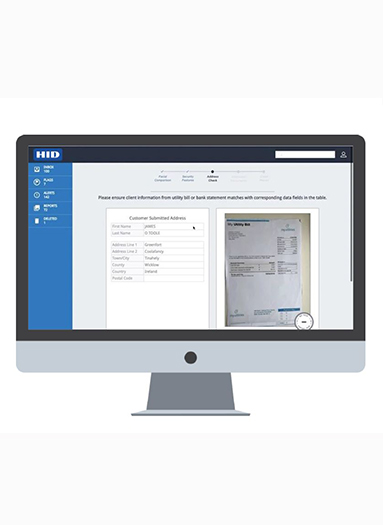

Address Verification

Business reviews and approves the customer’s proof of address Database checks are available enabling real time identity verification

Push Notification

Business can send push notifications to the customer if further action is required

Business Generates CDD Report

A Client Due Diligence Report is generated with all Customer ID information This report is stored securely online and may also be printed